Contents

During a downtrend or bear market the RSI tends to stay between the 10 to 60 ranges with the zones acting as resistance. These ranges will vary depending on the RSI settings and the strength of the security’s or market’s underlying trend. Swing traders are always looking for trading signals from RSI. They keep an eye on stocks where price momentum is fading out or picking up strength.

Welles Wilder, is a momentum oscillator that measures the speed and change of price movements. Traditionally the RSI is considered overbought when above 70 and oversold when below 30. Signals can be generated by looking for divergences and failure swings. As you can see in the following chart, a bullish divergence was identified when the RSI formed higher lows as the price formed lower lows. This was a valid signal, but divergences can be rare when a stock is in a stable long-term trend.

- You can consider any time period, but 14-day RSI is the commonly used.

- It measures the speed and magnitude of a coin’s recent price changes to evaluate overvalued or undervalued conditions in the price of that coin.

- The moving averages such as exponential moving averages which respond quickly to recent price changes can complement RSI signals to make better trades.

- Now we are coming to an important part i.e. how to apply range shift behavior on the chart and how to utilize this behavior to maximize gains and to enter and exit the position.

- This region isoverbought zoneor we can say that the index is heavily bought and is ready for a downward correction.

This article will talk about the 2ndM which is ‘Method’. But in addition to your method you can use this method for confirmation or running your profit long. A 5-day email course with amazing tips on trading, different trading instruments, and how to finalize a trading system. Get a best-selling eBook and online course by signing up for free. Even if you can catch the top, you may not be able to make big money, as sitting in the position is also a challenging task for most retail traders. This is the Reverse Engineering EMARSI and SMARSI Indicator.

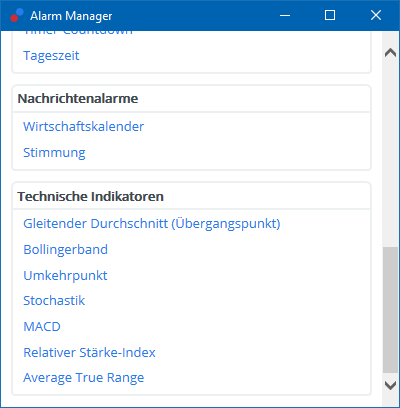

What Is the Difference Between RSI and Moving Average Convergence Divergence (MACD)?

The better you understand how RSI works, the more you can start benefiting from one of the most underrated but influential stock market calculation tools available. Wilder categorised divergence as positive and negative divergence. He opined that directional movement doesn’t confirm a price, and so you need to identify deviation for a potential change in trend. Divergence is a condition where the price line and RSI move in the opposite direction.

Aggressive traders can even find short selling opportunities. But remember to place a short trade only when you see a confirmation from the stock price. RSI shows zero value when the Average Gain value equals zero.

The bearish divergence means the bulls are losing momentum and the bearish trend is about to start. Needless to say, this is a signal to sell off and exit from the market. Technical analysis has a set of tools called https://1investing.in/ momentum indicators or oscillators. The indicators are very useful in deciphering the strength of a price trend. At the same time, these are lead indicators unlike a moving average which is lag indicator.

Recall that when the RSI is above 70, the stock is in the overbought zone. So, here the stock is very close to the upper band or the overbought region. MFs need structural changes to protect investors and en … This divergence might signify a price reversal if underlying prices make a new high or low that isn’t verified by the RSI.

This script is also a complement of «Reverse Engineering RSI, by… RSI indicators may not prove to be as useful in the face of strong market trends. If underlying prices make a new high or low that x inefficiency isn’t confirmed by the RSI, this divergence can signal a price reversal. If the RSI makes a lower high and then follows with a downside move below a previous low, a Top Swing Failure has occurred.

What is the Oscillator?

So what do you think about the RSI indicator, easy to understand? Do let us know your opinion on the RSI indicator and how it has helped you in making trading decisions as well as shaping your portfolio. If the RSI indicator is below 30, the security is considered to be oversold. Bearish Failure Swing – When RSI moves above 70, then pulls back below 70 and then bounces back but fails to move above 70 and then breaks its prior low, it signals sell. Once there are 14 periods of data available, the second calculation can be done.

Usually, if a stock price moves above 70 percent RSI, it is considered overbought. Likewise, if a stock price falls below 30 percent, it is deemed to be oversold. The next step involves dividing the average gains by the average losses for getting the figure of Relative Strength.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. The RSI forms another dip without crossing back into oversold territory.

Here wherever the RSI breaks 70, we say it is in the overbought zone. Whenever something is overbought, it means it has gone through most of the logical profits, and hence, it needs to be sold. Similarly, when RSI is in the oversold zone, it has hit its low and will rise, so it is a good buy. This is because the market has already been stretched, and price always moves in a zigzag pattern. To understand RSI, we must understand the oscillator model and its work. The oscillator model is handy for stock market analysts when a stock fluctuates, price-wise, in a narrow band.

Is part of the IIFL Group, a leading financial services player and a diversified NBFC. The site provides comprehensive and real time information on Indian corporates, sectors, financial markets and economy. On the site we feature industry and political leaders, entrepreneurs, and trend setters.

The Relative Strength Index tells you about the stock’s current situation and whether it is overbought or oversold. If the stock is overbought, it means it can correct itself, and if it is oversold, it means that it can climb higher soon. This is a MTF HUD built around Chartguy Dan’s trading style of 12/26 EMAs and RSI levels from multiple time frames. The HUD is configurable, allowing you to change the time frame of RSI levels and EMAs. The EMAs can be displayed at their current price or a percentage distance away.

Relative Strength Index (RSI)

On Tuesday it moves to Rs 1,050 and to Rs 1,100 on Wednesday. This indicates that the stock has ahigh momentumas it has moved upward by 10% in just 2 days. In this chart, the RSI touches the 30 mark, the threshold of oversold zone and then rises to 40, the fail point.

Similarly, the absolute losses on each of the five days are added up and divided by 14 to get the average losses. The ratio between these values (average gains / average losses) is known as relative strength . RSI is a potential oscillator indicator that gives traders visual representation when the price trend is shifting. If we remain aware of its limitations, it is a powerful price action tool to understand trend reversal in advance.

The RSI is displayed as an oscillator which ranges between 0 to 100. The term “Relative Strength Index” unlike the name suggests does not compare the relative strength of different securities, but instead shows the price movement of the securities. Typically, indicators are of two types, leading and lagging.

Its purpose is to smooth the results so that the RSI only nears 100 or zero in a strongly trending market. An asset is usually considered overbought when the RSI is above 70 and oversold when it is below 30. E) Trading / Trading in “Options” based on recommendations from unauthorised / unregistered investment advisors and influencers. B) Trading in leveraged products /derivatives like Options without proper understanding, which could lead to losses.

What is ‘Relative Strength Index’

During trends, the RSI readings may fall into a band or range. During an uptrend, the RSI tends to stay above 30 and should frequently hit 70. During a downtrend, it is rare to see the RSI exceed 70. Many investors create a horizontal trendline between the levels of 30 and 70 when a strong trend is in place to better identify the overall trend and extremes. The relative strength index is a popular momentum oscillator introduced in 1978.

Nifty settles at 18,100 level, registers nearly 5 per cent returns in CY 2022; PSU…

Generally, when the RSI indicator crosses 30 on the RSI chart, it is a bullish sign and when it crosses 70, it is a bearish sign. Put another way, one can interpret that RSI values of 70 or above indicate that a security is becoming overbought or overvalued. It may be primed for a trendreversalor corrective pricepullback. An RSI reading of 30 or below indicates an oversold or undervalued condition. A related concept focuses on trade signals and techniques that conform to the trend. On the other hand, modifying overbought or oversold RSI levels when the price of a stock or asset is in a long-term horizontal channel or trading range is usually unnecessary.

RSI calculates strength of stock trend and helps to predict their reversals. But it is not necessary that an RSI convergence should indicate a reversal. The price may continue to fall and hence calls for caution from a trader. The resultant is a positive divergence when the higher lows of RSI are aligned with lower lows of the price, provided the RSI shows an oversold reading.

When the RSI rises above 70, it is considered overbought, and when it falls below 30, it is deemed oversold. If required, these conventional levels can be changed to better meet the security. If a security is consistently approaching the overbought threshold of 70, for example, you might wish to raise it to 80. The RSI may linger in overbought or oversold territory for lengthy periods of time during strong movements.