Content

This implies that in your initial years, you will be on your own. The first and foremost way to keep up with your finances is by ensuring your bookkeeping skills are on point. Excellent bookkeeping skills allow you to account for every little profit you earn, as well as for the corresponding expenses. FreshBooks ($15 to 50 per month) launched a brand-new version of its service a few years ago and has been slowly migrating features over from FreshBooks Classic.

Who is higher than an accountant?

A controller, or comptroller, oversees the accounting operations of a firm, including managing staff. Because controllers' duties and responsibilities expand beyond that of an accountant, they typically command larger salaries.

At accountant for freelancers we offer hassle-free solutions for busy freelancers working in the UK and aim to take away the pressures that exist with accounts filing and tax calculations. We strive to make the working lives of every freelancer we support easier and less stressful via our easy-to-understand processes and friendly, UK-based staff. We are very proud to boast a fantastic team of accountants, tax specialists, client managers and business consultants, all with varying levels of qualification and expertise.

Bookkeeping for freelancers

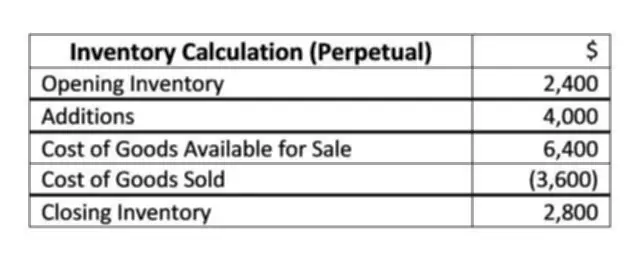

Luckily, there are many https://www.bookstime.com/ in the marketplace that will help you easily input your financial data anywhere and at any time. Accounting software will help you organize your finances by tracking outstanding invoices, managing your cash flow, invoicing clients and ensuring you have accurate financial records. Sunrise is a good choice for freelancers and sole proprietors who need to track income and expenses and invoice customers. It might also appeal to small businesses that need double-entry accounting but not time tracking, robust reports, or full mobile access. Fulfilling your accounting obligations as a freelancer is not complicated as long as you’re clear about what you must do and are organized enough to do it on a regular basis. Opening a dedicated account for your business and keeping up-to-date invoices and financial records are all manageable tasks.

For more than a decade, Jonathan has focused his New York City CPA practice on helping freelancers and the self-employed. Some accountants may outsource their tax preparation work to someone else. It is important to find out beforehand, who will prepare your taxes.

Don’t forget traditional marketing

A Professional with over 13 year’s & more experience balancing the need of Individuals,corporate firms, companies Equally strong competencies in account managem… I’m a qualified chartered accountant with expertise in all major accounting fields. As well as a certified Xero advisor with over 4 years’ experience provid… As you make bookkeeping a part of your daily routine, you’ll be able to spend less time on it. This will give you more time to focus on your day-to-day work and even help you plan future growth.